Loan data analysis

Loan data: size matters

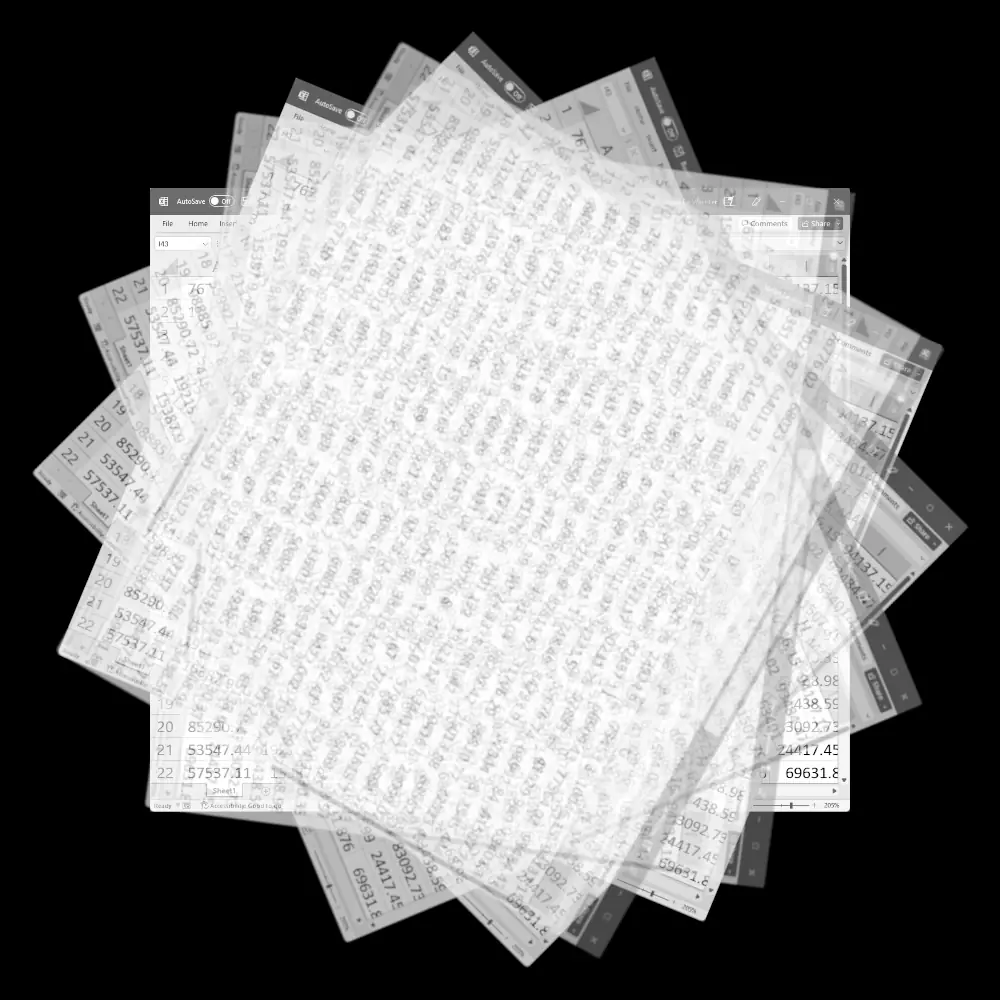

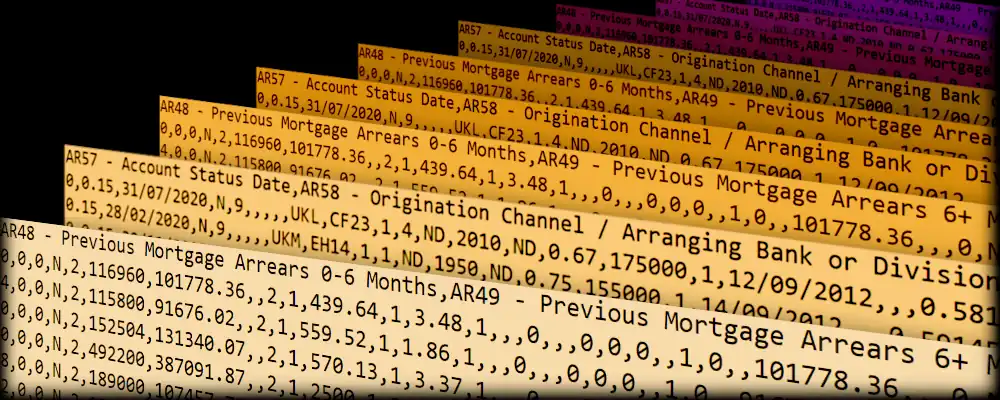

Retail loan portfolio transactions come with large data sets on portfolio composition and historical performance, with file sizes sometimes running into the gigabytes. This in itself poses problems for the Excel-based approach to cashflow forecasting many financial analysts are familiar with. Historical performance information in particular is difficult to analyze without relatively sophisticated technical machinery.

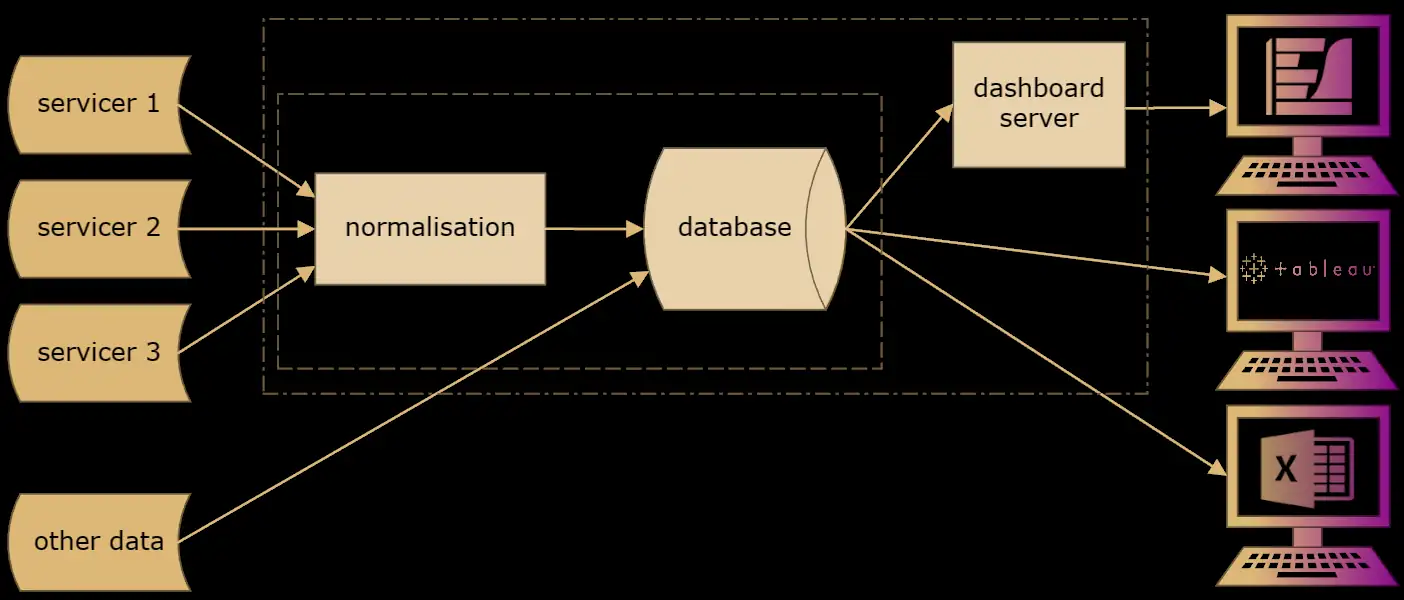

Our loan analysis service employs such machinery in the form of purpose-built software libraries, which allow us to deliver results quickly whilst avoiding error-prone spreadsheet calculations. A decade of experience working across the full life-cycle of loan portfolio acquisitions helps guide valuations when data alone do not provide the answer.

Features

- Data cleaning and organization.

- Detailed portfolio composition analysis, in graphical and tabular format.

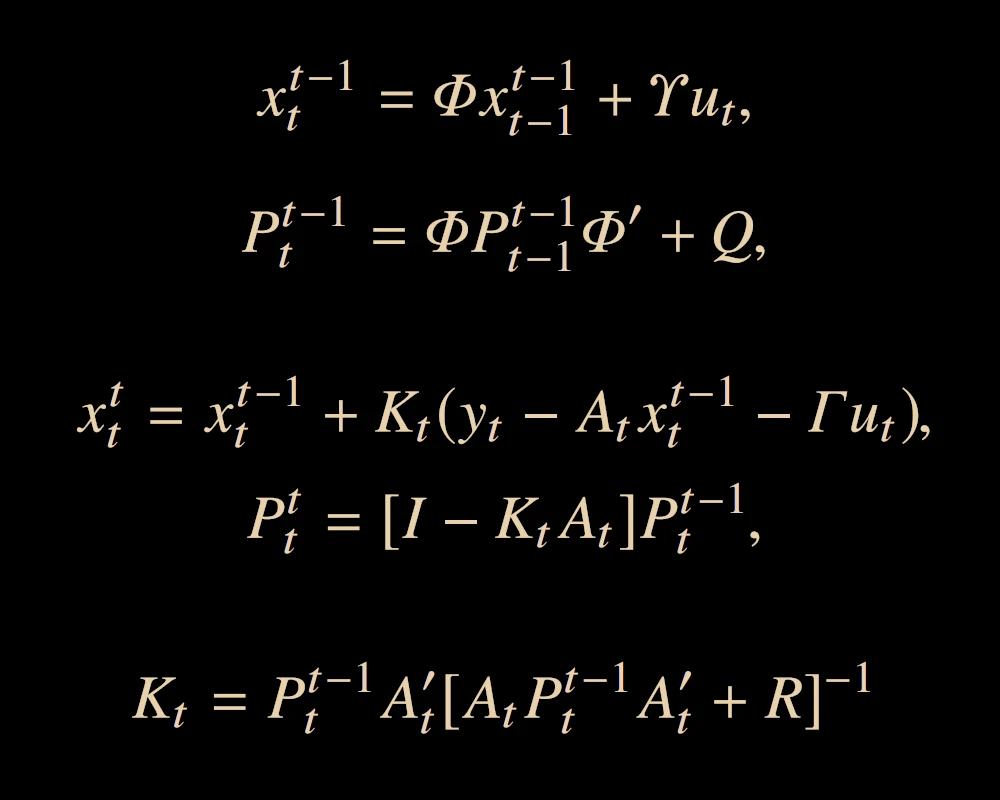

- Flexible specification of loan-level prepayment and default forecasts.

- Optional econometric model-driven forecasts where appropriate historical data for model calibration are available.

- Clear pdf-format report with data, forecasts and hand-written commentary.

- Use as an add-on to your deal team for fast interaction, or stand-alone e.g. as a back-up for your own computations.

Contextual information

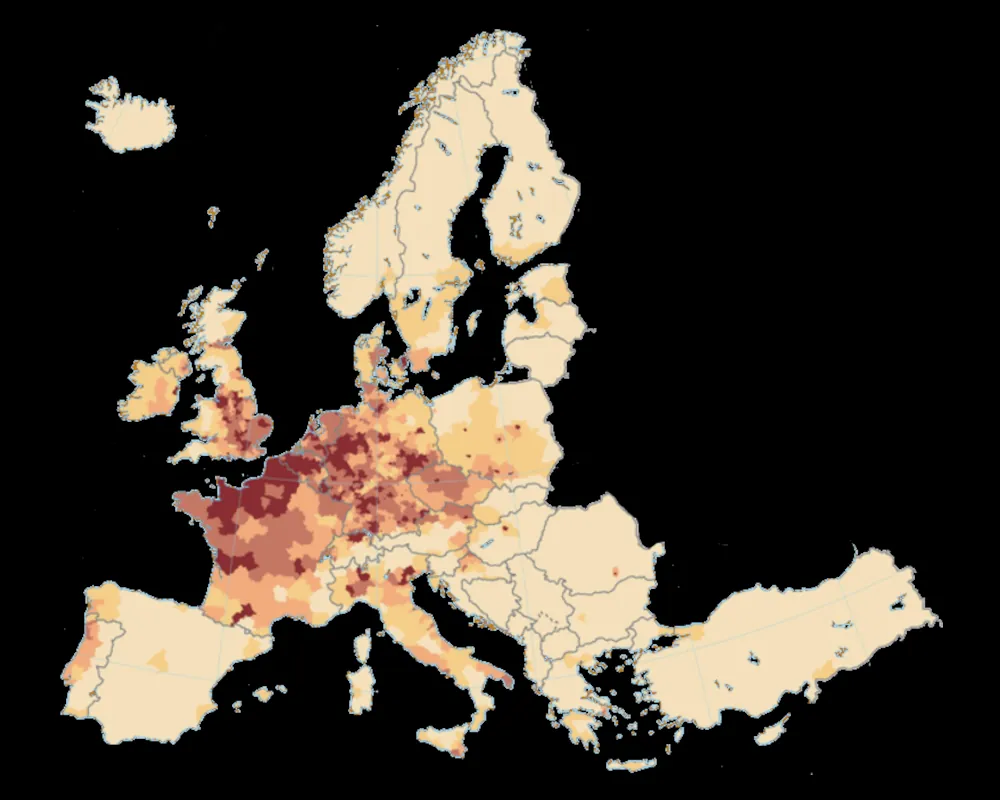

Loan data, and mortgage loan data in particular, often include a wide set of attributes. This creates the possibility to augment the analysis with contextual data. For example, when precise property location information is at hand, one can link this to regional macro-economic, demographic and property transaction data in order to paint a more detailed picture of the portfolio than is possible with the loan tape alone.

We continue to invest in regional macro and housing research to build this capability. Data availability varies widely across jurisdictions; where possible the results are integrated into our portfolio valuation reports.